Sona BLW Precision Forgings Ltd

Sona BLW Precision Forgings Ltd., also known as Sona Comstar, is a prominent Indian automotive technology company specializing in the design, manufacturing, and supply of precision-engineered components for both electrified and non-electrified powertrains. Established in 1995, the company has evolved into a global supplier with a presence across India, China, Mexico, and the USA.

1.

Core Business & Products

Sona Comstar offers a diverse range of products catering to various vehicle categories, including:

-

Differential assemblies and gears

-

Conventional and micro-hybrid starter motors

-

Belt Starter Generator (BSG) systems

-

Electric Vehicle (EV) traction motors (BLDC and PMSM)

-

Motor control units

These products serve a wide array of vehicles, from passenger and commercial vehicles to electric two- and three-wheelers.

Global Footprint

With ten manufacturing facilities spread across India, China, Mexico, and the USA, Sona Comstar has established a robust global presence, supplying components to original equipment manufacturers (OEMs) in the US, Europe, India, and China.

Financial Snapshot (as of March 31, 2025)

-

Revenue: ₹3,681.45 crore

-

Net Profit: ₹601.21 crore

-

Market Capitalization: Approximately ₹29,914 crore

-

Earnings Per Share (EPS): ₹9.42

-

Price-to-Earnings (P/E) Ratio: 51.08

-

Price-to-Book (P/B) Ratio: 5.72

-

Dividend Yield: 0.64%

-

Return on Equity (ROE): 10.94%

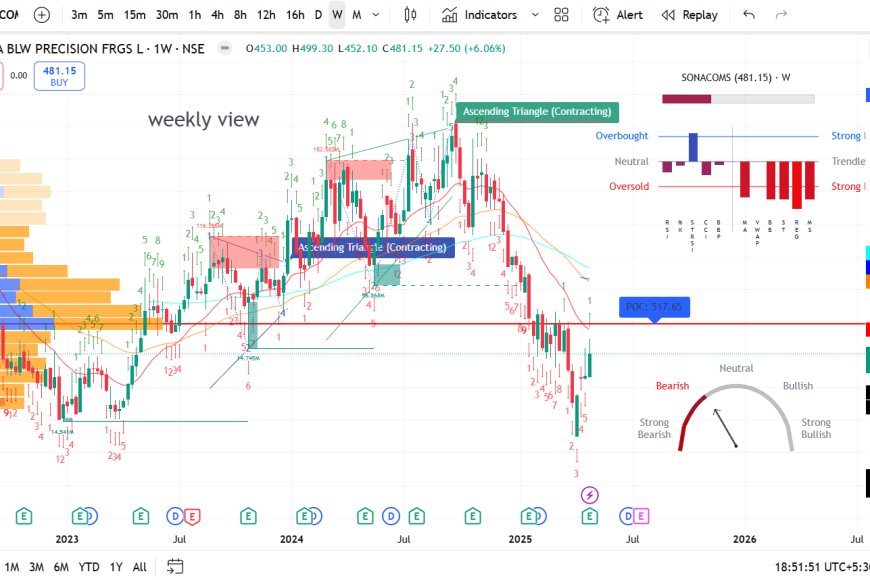

Stock Performance

As of April 30, 2025, Sona BLW Precision Forgings' stock was trading at ₹481.15 on the NSE, marking a 2.18% decrease from the previous close. The stock's 52-week range spans from ₹380.00 to ₹768.65.

Leadership & Ownership

-

Chairman: Sunjay Kapur

-

Managing Director & CEO: Vivek Vikram Singh

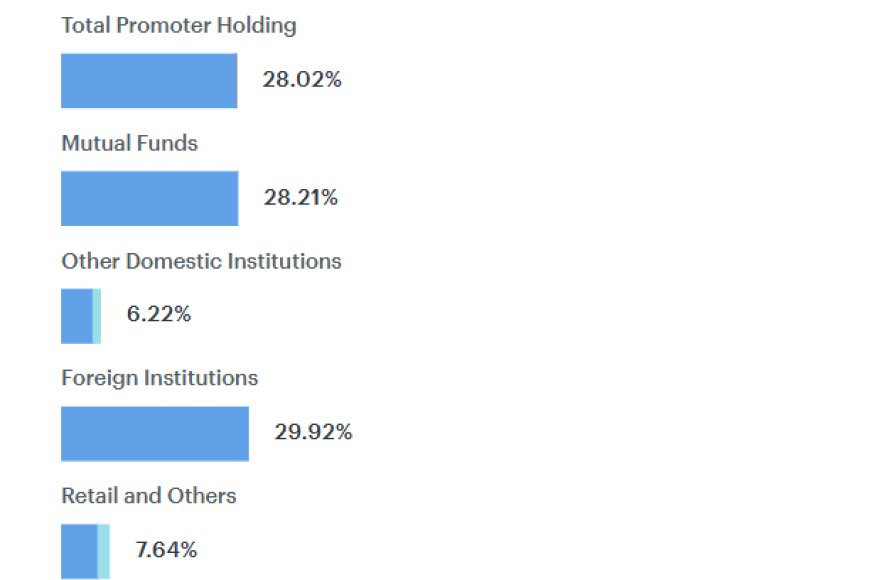

As of March 31, 2025, the shareholding pattern is as follows:

-

Promoters: 28.02%

-

Foreign Institutional Investors (FIIs): 29.91%

-

Mutual Funds: 28.21%

-

Retail and Others: 7.64%

-

Other Domestic Institutions: 6.22%

Analyst Outlook

Analyst consensus indicates a positive outlook for Sona BLW Precision Forgings, with a median 12-month target price of ₹620.97. The high and low estimates are ₹758.00 and ₹440.00, respectively. Out of 17 analysts, 6 recommend a "Strong Buy," 7 a "Buy," 2 a "Hold," and 2 a "Sell."

For more detailed information, you can visit their official website: sonacomstar.com.

pivopen

pivopen