Samvardhana Motherson International Ltd

Samvardhana Motherson International Ltd (SMIL) is a leading Indian multinational specializing in automotive components. Founded in 1986 as Motherson Sumi Systems Ltd, the company rebranded to its current name in May 2022. Headquartered in Noida, Uttar Pradesh, SMIL operates globally, serving major automotive manufacturers.

1. Overview

Company Overview

-

Founded: 1986

-

Headquarters: Noida, Uttar Pradesh, India

-

Chairman: Vivek Chaand Sehgal

-

Employees: Approximately 136,000 (as of 2024)

-

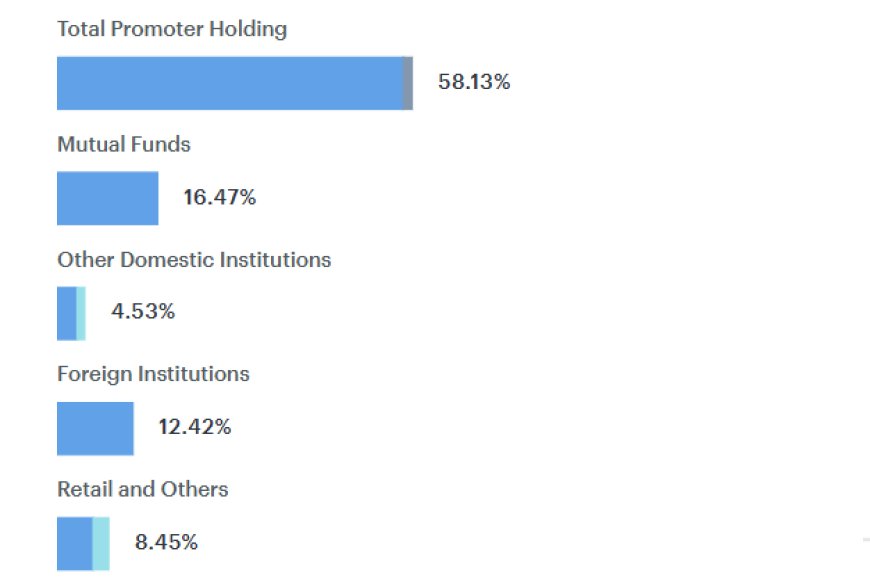

Ownership: Sehgal family (50.4%), Sumitomo Wiring Systems (9.73%)

-

Stock Listings: NSE: MOTHERSON, BSE: 517334

-

Market Capitalization: ₹93,773 crore (as of April 30, 2025)

Business Segments

SMIL offers comprehensive solutions across various segments:

-

Wiring Harnesses: Electrical distribution systems for vehicles

-

Modules & Polymer Products: Dashboards, door trims, bumpers, and other plastic components

-

Vision Systems: Interior and exterior mirrors, including camera-based detection systems

-

Integrated Assemblies: Complete module assemblies for automotive applications

-

Emerging Businesses: Ventures into elastomers, lighting & electronics, precision metals, technology solutions, logistics, aerospace, health & medical sectors

Financial Highlights (as of April 30, 2025)

-

Stock Price: ₹133

-

52-Week Range: ₹107.25 – ₹216.99

-

P/E Ratio: 22.7

-

Book Value: ₹46.4

-

Dividend Yield: 0.60%

-

Return on Capital Employed (ROCE): 13.7%

-

Return on Equity (ROE): 11.8%

-

Debt-to-Equity Ratio: 0.78

Global Presence & Clients

SMIL serves a diverse clientele, including:

-

Maruti Suzuki

-

Mercedes-Benz

-

Tata Motors

-

Volkswagen

-

Ford Motor

-

Porsche

The company has expanded its global footprint through strategic acquisitions, such as:

-

SAS Autosystemtechnik (Germany)

-

Yachiyo Industry's four-wheeler business (Japan)

-

Dr. Schneider Group (Germany)

Recent Developments

In September 2024, SMIL announced a Qualified Institutional Placement (QIP) to raise up to $715 million. The funds are intended for debt repayment, expansion, and capital expenditures. Financial advisors for this initiative include Axis Bank, HSBC, Jefferies, JM Financial, and Morgan Stanley.

pivopen

pivopen